MUMBAI (Ambedkar Chamber): The Reserve Bank of India (RBI) on Wednesday said it will change the way cheques are cleared in India. The new system will make cheque clearing faster and smoother for customers.

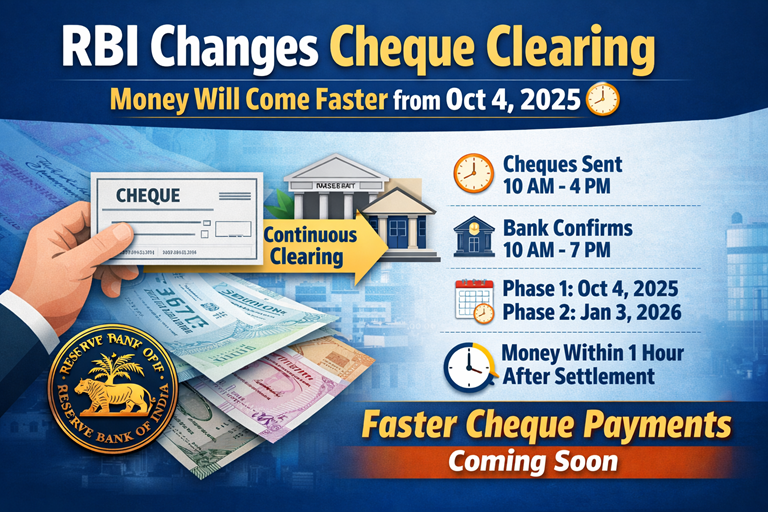

At present, cheque clearing happens in batch processing, meaning cheques are collected and cleared together at fixed times. Now, the RBI has decided to shift the Cheque Truncation System (CTS) to continuous clearing, where cheques will be processed throughout the day.

The RBI said this new system will be implemented in two phases — Phase 1 from October 4, 2025 and Phase 2 from January 3, 2026.

The central bank has asked all banks to inform customers properly about this change and be ready for the new process on the given dates.

What Will Change for Customers?

This change mainly means that cheques will be cleared faster, and customers may receive money sooner compared to the current process.

1. Cheques will be sent continuously (10 AM to 4 PM)

- Banks will have one presentation window from 10:00 AM to 4:00 PM.

- As soon as a bank branch receives a cheque, it will scan it and send it immediately to the clearing system.

- The clearing house will send the cheque image to the other bank (drawee bank) without waiting.

2. Other bank must confirm the cheque (10 AM to 7 PM)

- The bank on which the cheque is written must confirm whether the cheque is accepted or rejected.

- The confirmation time window will be from 10:00 AM to 7:00 PM.

- If the cheque is accepted, it is called positive confirmation.

- If the cheque is rejected, it is called negative confirmation.

3. If a bank doesn’t reply, cheque will be treated as approved

RBI has set rules so that cheques don’t get delayed.

Phase 1 (Oct 4, 2025 to Jan 2, 2026)

- The bank must confirm the cheque by 7:00 PM.

- If the bank does not confirm by 7 PM, it will be treated as approved automatically and included for settlement.

Phase 2 (From Jan 3, 2026)

- Banks will get only 3 clear hours to confirm a cheque.

- Example: If a bank receives a cheque image between 10 AM and 11 AM, it must confirm it by 2 PM.

- If it does not confirm, the cheque will be treated as approved automatically and settled at 2 PM.

4. Settlement will happen every hour (from 11 AM)

- Earlier, cheque settlement was not continuous.

- Now, settlement will happen every hour starting from 11:00 AM till 7:00 PM.

- Only cheques with positive confirmation (or deemed approved) will be settled.

- Cheques with negative confirmation will not be settled.

5. Customers will get money quickly

- After every settlement, the presenting bank will receive confirmation details.

- The presenting bank must release payment to the customer immediately, and not later than 1 hour after settlement (subject to normal safeguards).

RBI’s Instruction to Banks

The RBI directed banks to:

- Explain the new clearing process to customers, and

- Be ready to implement continuous clearing on October 4, 2025 and January 3, 2026.

The RBI directive is issued under the Payment and Settlement Systems Act, 2007.